Foreign students, scholars, teachers, researchers, and trainees and other nonimmigrants temporarily present in the United States in F-1, J-1, M-1, Q-1 or Q-2 status, who are Nonresident aliens for federal tax purposes might qualify for an exemption from Social Security and Medicare (FICA) taxes. Click here to see if you are a resident alien or nonresident alien.

1. How do I know if my employer incorrectly withheld SSN and Medicare Taxes?

If you are a nonresident alien for federal tax purposes and you completed your onboarding paperwork correctly with your employer, they should not have withheld any FICA taxes. Take a look at your W2. Box 4 and Box 6 of your W2 should not have any amounts in them.

If you have not been issued a W2 yet, you can take a look at your weekly/monthly payslips for the tax withholding breakdown and that should tell you if FICA taxes have been withheld from your pay.

2. What is the easiest and the quickest way to request refund?

Requesting the FICA refund directly from your employer is the easiest and quickest way. They can issue you a refund directly and issue you a corrected W2C because everything is handled in house by your employer’s payroll department. However, not every employer will issue you a refund and might tell you to request it back when you file your tax returns. Requesting the refund from the IRS can take a few months. Currently IRS has a backlog of about 6 Million unprocessed tax returns from 2019/2020. Abatements are probably the last on their list. However, it’s not impossible to request it from the IRS. Follow the steps below to requerst the refund directly from the IRS. You might have to wait a few months to receive it.

3. How can I request the FICA taxes back?

Steps to request a refund for FICA taxes: (Complete Step 1 to Step 5 for every employer)

Step#1. Contact your employer and ask them to refund you the FICA taxes. Explain to them that you are a nonresident alien for federal tax purposes and that they should not have withheld these taxes in the first place. You can also forward them this link so they can read about it themselves. If they refuse to issue you a refund or do not respond to your request, follow the steps below:

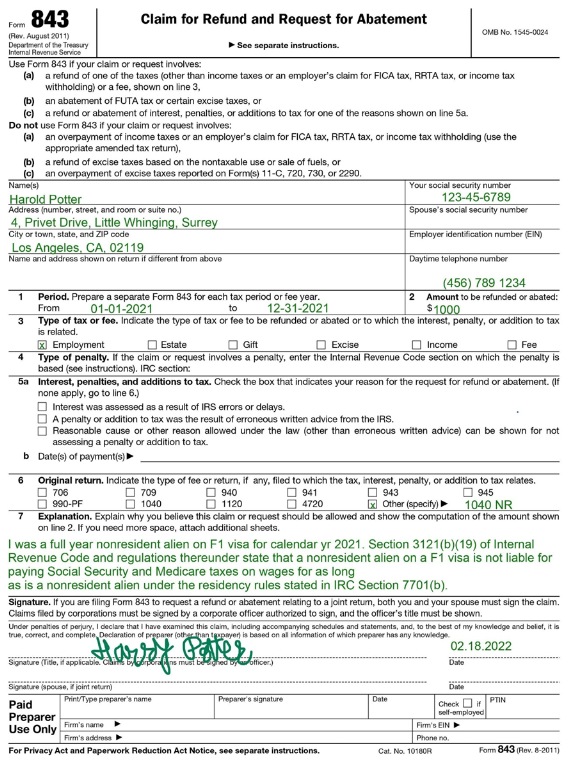

Step#2. Fill out Form 843 (Click to Download) ^1^

- Enter your name, current address, social security number and phone number in the first section. You can leave the EIN section blank.

- Line 1 – Enter the start and end date of the calendar year that this form corresponds to. for eg: 01/01/2021 to 12/31/2021

- Line 2 – Amount to be refunded/abated. You can calculate this by adding Box 4 (SSN taxes) and Box 6 (medicare taxes) of your W2.

- Line 3 – Select Employment.

- Line 4 and Line 5 – Leave blank.

- Line 6 – Check the box for your original return – If it is 1040 NR, check “Other” and write 1040 NR.

- Line 7 – Copy and paste the following words: “I was a full year nonresident alien on F1 visa for calendar year 2021. Section 3121(b)(19) of Internal Revenue Code and regulations thereunder state that a nonresident alien on a F1 visa is not liable for paying Social Security and Medicare taxes on wages for as long as is a nonresident alien under the residency rules stated in IRC Section 7701(b).”

- Sign and Date the form.

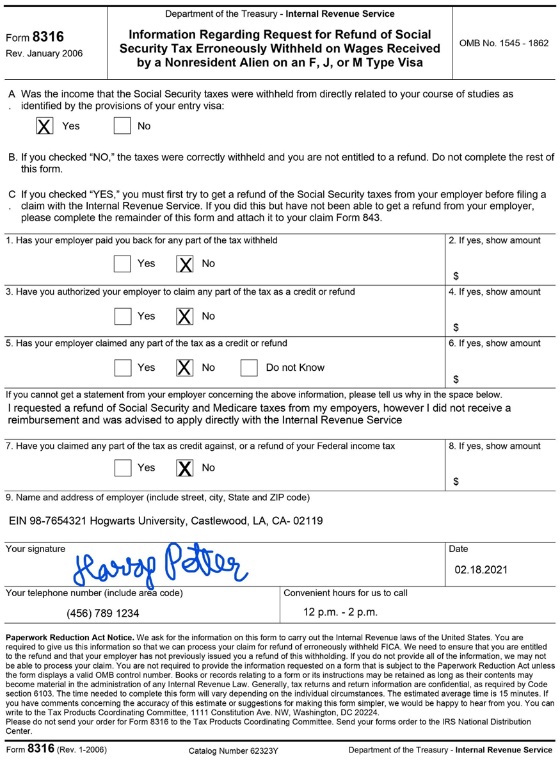

Step#3. Fill out Form 8316 (Click to Download)

- Line A- Check “Yes”

- Line 1, Line 3, Line 5 and Line 7 – Check “No”

- After Line 6 and before Line 7, for the reason column, cop and paste the following words: “I requested a refund of Social Security and Medicare taxes from my employers, however I did not receive a reimbursement and was advised to apply directly with the Internal Revenue Service”

- Line 9 – Write Complete Address of your Employer and EIN for your employer (can be found on your W2)

- Sign and Date the form

- Write your telephone number and a convenient time to call in the lines that follow.

Sample 843 and 8316 Forms

Sample Form 843

Step#4. Assemble the package:

Sample Form 8316

- SIGNED and DATED Form 843 and Form 8316

- Attach a copy of your W-2(s) for the employer who incorrectly withheld your FICA taxes

- Attach a copy of your passport

- Attach a copy of your US visa (should be in your passport)

- Attach a copy of your most recent I-94

- Attach a copy of the I-20 from the same time your were on CPT or OPT.

- I-20 must indicate if you were engaged in CPT or OPT

- If engaged in OPT at the time, Include a copy of Form I-766 (Employment Authorization Document – EAD)

Step#5. Mail the entire package to:

Department of the Treasury,

Internal Revenue Service Centre,

Ogden, UT 84201-0038.

Some Important points to note:

- Do NOT staple any pages.

- Do NOT send your account/routing number.

- You will be mailed a check to the address on the forms. It can take more than 6 months for IRS to process your abatement because of COVID backlog.

- Complete Step 1 to Step 5 for every employer.

Sources:

Source 1: Article- Social security and medicare taxes withheld

Source 2: Instructions for Form 843