You are usually not required to file a tax return if your salary/W2 income is less than the standard deduction ($13,850 for Single/$27,700 for Married Filing Jointly in 2023) ^1^. Was your income below that? YOU HAVE TO FILE YOUR RETURNS TO GET A REFUND! You can ask for all the tax withheld by your employer as a refund if your income was below the filing threshold.

Have you already filed your tax returns – Form 1040/1040SR/1040NR? Are you expecting a refund from the government? Here’s how you can track your refund:

As per the IRS, you should get your refund within:

- 21 days of receiving your e-file acceptance notification

- 4-6 weeks of mailing your paper return ^2^

You can track your federal refunds here. Or type in “Where is my Refund” on your browser and it will take you to this very page of the IRS.

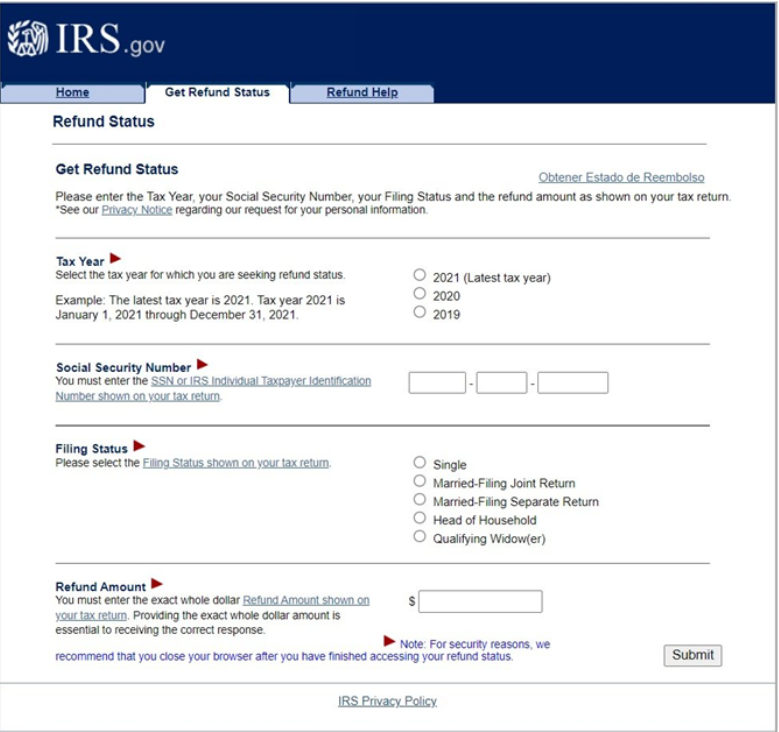

You will get a screen like this:

This page has FOUR fields that are required to be completed:

- The Tax Year for which you are seeking the Refund for

- Your Social Security Number

- Your Filing Status : Single/ Married Filing Jointly/ Married Filing Separate/ Head of Household/ Qualifying Widower

- Your Refund amount to the exact dollar.

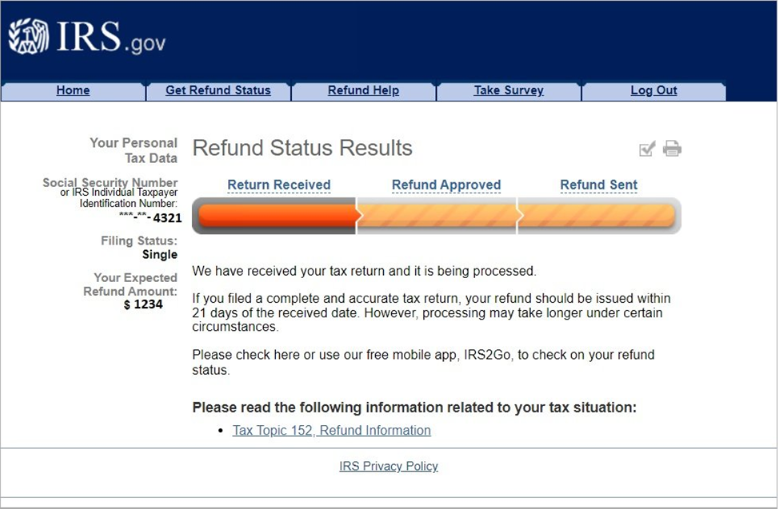

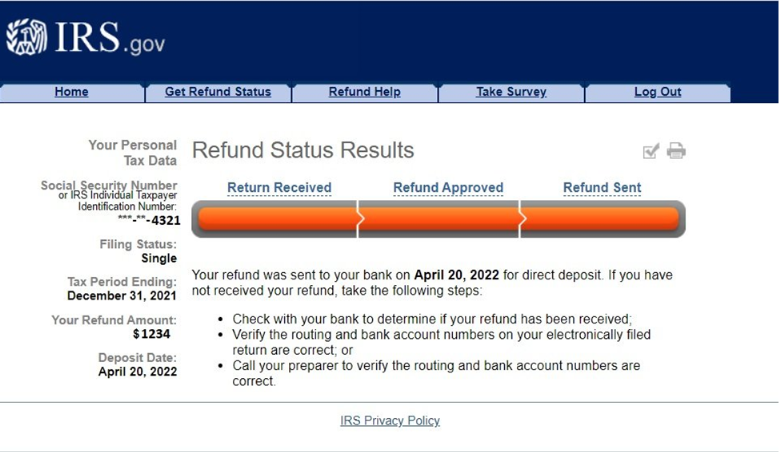

Once you enter the correct details, you shall get a screen like either of these:

The bar shows the exact status of your refund, and in case it is already deposited, the date it was deposited (See image 2). You may call the IRS if the specified time (21 days or 6 weeks) have passed and you still haven’t received your refund OR your “Where’s My Refund” says we can provide more information to you over the phone.

Sources:

Source 1: Tax inflation adjustments for tax year 2023

Source 2: Tax Season Refund FAQs