If you live and work outside the United States, you may not have to pay U.S. taxes on all of your income. The IRS allows you to exclude a portion of your foreign wages or self-employment income by filing Form 2555. This document, which you use to claim the Foreign Earned Income Exclusion (FEIE), can reduce your taxable income by over $100,000 if you meet the right criteria.

Form 2555 isn’t long, but it can be difficult to complete. Many expats also miss out on this exclusion or file it incorrectly because they don’t know how the IRS counts time spent overseas. This guide explains who should use Form 2555, what you need to prepare, and how USA Tax Gurus can help.

USA Tax Gurus is a team of enrolled agents and licensed CPAs who can help you take control of your business finances to maximize profits, reduce taxes, and provide increased financial clarity. We’re QuickBooks Pro Advisors, but our tech-savvy team can work in almost any accounting platform, including Wave, Zoho, and more. Schedule your free consultation today with a member of our team to learn more!

What Is IRS Form 2555?

IRS Form 2555 is the form you use to claim the Foreign Earned Income Exclusion. If you qualify, this exclusion lets you keep a portion of your income from being taxed by the U.S. government. For the 2025 tax year, you can exclude up to $130,000 of foreign-earned income. If you’re married and both spouses qualify, you can each exclude that amount separately.

The form is filed with your regular federal tax return. Bear in mind that it doesn’t replace your Form 1040 – it goes with it. Form 2555 will ask you for information about your foreign income, your location abroad, and how long you’ve lived or worked outside the U.S. It also asks which test you’re using to qualify: the bona fide residence test or the physical presence test.

Note: Form 2555 only applies to income you earn from working. This means wages, salary, tips, bonuses, and self-employment income. It doesn’t apply to dividends, interest, pensions, or rental income. It also won’t apply if you live in the U.S. and work remotely for a foreign company. You must be physically present in another country for most or all of the year, and your tax home must be outside the U.S.

Who Should File Form 2555?

You should file Form 2555 if you’re a U.S. citizen or resident alien who earned income abroad and lived in a foreign country long enough to qualify for the exclusion. This applies to:

- People working overseas for a company

- Contractors with foreign clients

- Digital nomads with steady foreign income, and others with similar work setups.

You’ll need to meet the IRS requirement for a foreign tax home and pass either the bona fide residence test or the physical presence test.

The bona fide residence test applies if you’ve lived in another country for at least one full calendar year and made it your primary place of residence. This doesn’t mean you have to own property or stay permanently, but the IRS will review your intent to live there long-term. The physical presence test is more flexible: it lets you qualify by being outside the U.S. for at least 330 full days during any 12-month period. Many remote workers and contractors qualify this way.

You should also file if you want to claim the foreign housing exclusion or deduction: if you’re paying high rent or utilities abroad, those extra expenses may give you a bigger tax break. Just remember that the income you’re excluding must be earned: passive income or capital gains don’t count. If you’re unsure which test fits your situation, it helps to review your travel calendar and talk to a tax professional before filing.

What You’ll Need Before You Start

Before you fill out Form 2555, you’ll need to gather records that prove where you lived, how much you earned, and how long you stayed outside the U.S. The IRS doesn’t accept estimates, so accuracy is extremely important. Even a small error in dates or income amounts can delay your return or reduce the exclusion you’re trying to claim.

Collect Your Travel Documentation

Start by collecting your travel records. If you took several trips back and forth between different countries, you’ll need exact arrival and departure dates. Your passport, flight confirmations, and even visa stamps can help you build a full travel timeline. If you’re using the physical presence test, these records will show whether you reached the 330-day requirement.

Collect Proof of Income

Next, gather documents that show your income. This might include foreign pay slips, employment contracts, or self-employment invoices. If your income was paid in a foreign currency, you’ll need to convert it to U.S. dollars using IRS-approved exchange rates. You should also collect proof of your foreign address and housing expenses, especially if you plan to claim the housing exclusion. Rent receipts, lease agreements, and utility bills are all useful.

If you’re unsure about how to track exchange rates, how to treat part-year income, or whether your housing costs qualify, it may be time to ask for help. Form 2555 isn’t long, but it does rely on accurate supporting data. Preparing ahead will save time when it’s time to file.

Step-by-Step Instructions: How To Fill Out Form 2555

Form 2555 is split into five main sections. Here’s how to work through each part, one section at a time.

A. Part I – General Information

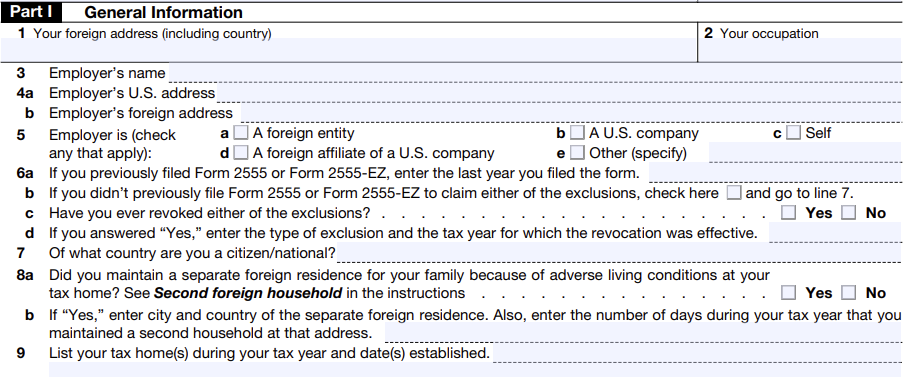

Start by entering your name and Social Security number. You’ll also write the tax year you’re filing for. If you’re reporting income earned in 2024, make sure that’s the year listed.

Next, you’ll fill in your U.S. address (if you have one) and your foreign address, including the country. (Be as accurate as possible, as the IRS may compare this with other parts of your return.) You’ll also need to give your employer’s name and address. If you’re self-employed, write “self” and provide your business address.

You’ll then check which parts of the form you’re using. Most people filing Form 2555 will check the box for the Foreign Earned Income Exclusion. If you also qualify to exclude housing costs, you’ll check the Housing Exclusion box. If you’re self-employed and claiming housing expenses as a deduction, you’ll check the Housing Deduction box.

This stage sets the foundation for everything that follows. If anything here is missing or inconsistent, the IRS may reject your exclusion or request more information later.

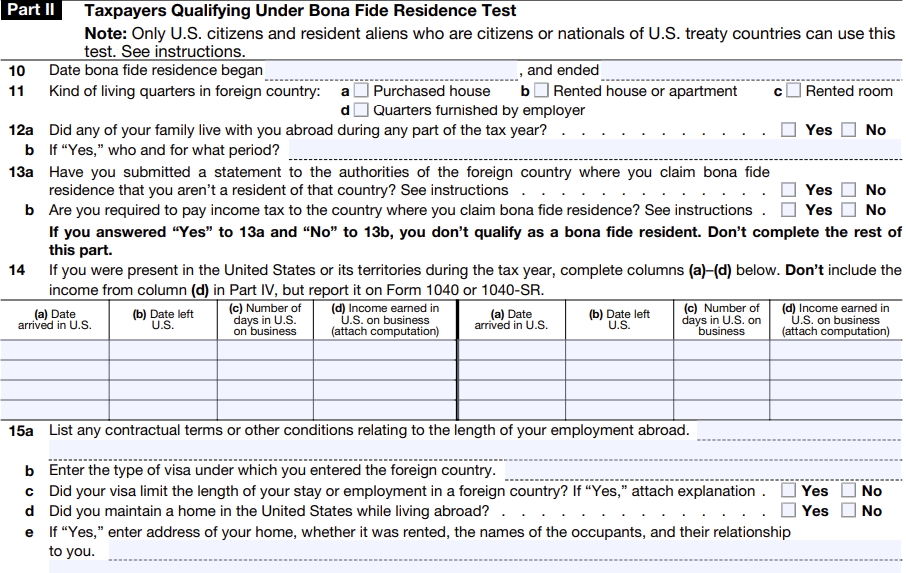

B. Part II – Tax Home and Residency Test

This part confirms that your main place of work and income (your tax home) was outside the United States. The IRS defines your tax home as the location where you regularly work and earn income, not necessarily where your family lives or where you maintain a permanent residence.

For example, if you live and work in France for most of the year as a software contractor, France is your tax home. That’s true even if your spouse and children remain in the U.S. and you visit them occasionally. Since your income is tied to your work in France, that’s what matters when determining your tax home.

Then you’ll indicate which test applies:

- Bona Fide Residence Test: This test requires you to be a resident of a foreign country for an uninterrupted period that includes a full calendar year. You’ll enter the dates your residency began and ended, and name the country. You’ll also need to explain the nature of your stay, such as whether you had a permanent home, paid taxes locally, or planned to stay long-term.

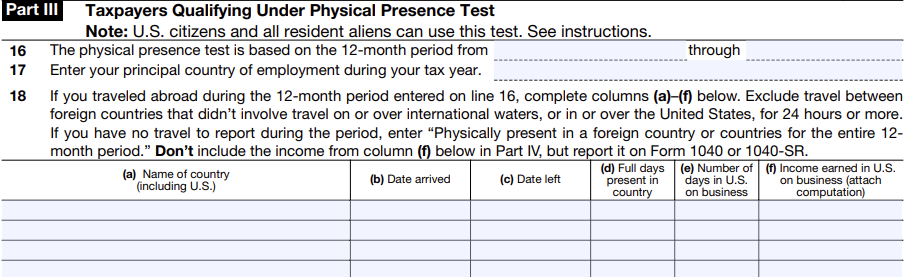

- Physical Presence Test: This test is based on how many full days you were outside the U.S. during any 12-month period. The key number is 330 full days. You’ll enter the exact dates of that 12-month period and be prepared to show where you were each day. The days don’t have to fall within a calendar year – they just need to add up to 330 over a rolling 12-month period.

Pro Tip: Be careful not to list vacation days spent in the U.S. as part of your qualifying period. Full days in the U.S., even for short visits, don’t count toward the 330 days.

C. Part III – Foreign Earned Income

This section asks you to report how much income you earned while living and working abroad. You’ll enter the name and address of your foreign employer. If you’re self-employed, list the name of your business or write “self” if you work independently. You’ll then describe the type of work you do: for example, software development, marketing, consulting, or teaching. Be brief but clear.

Next, report how much you earned and convert it to U.S. dollars. You can normally use the yearly average exchange rate, unless your income changed drastically over the year or was paid in large lump sums. The IRS website and some tax software tools offer current and historical exchange rate tables.

Pro Tip: If your income was reported on a foreign pay stub, keep a copy in your records. You don’t need to attach it, but you may need it if your return is reviewed.

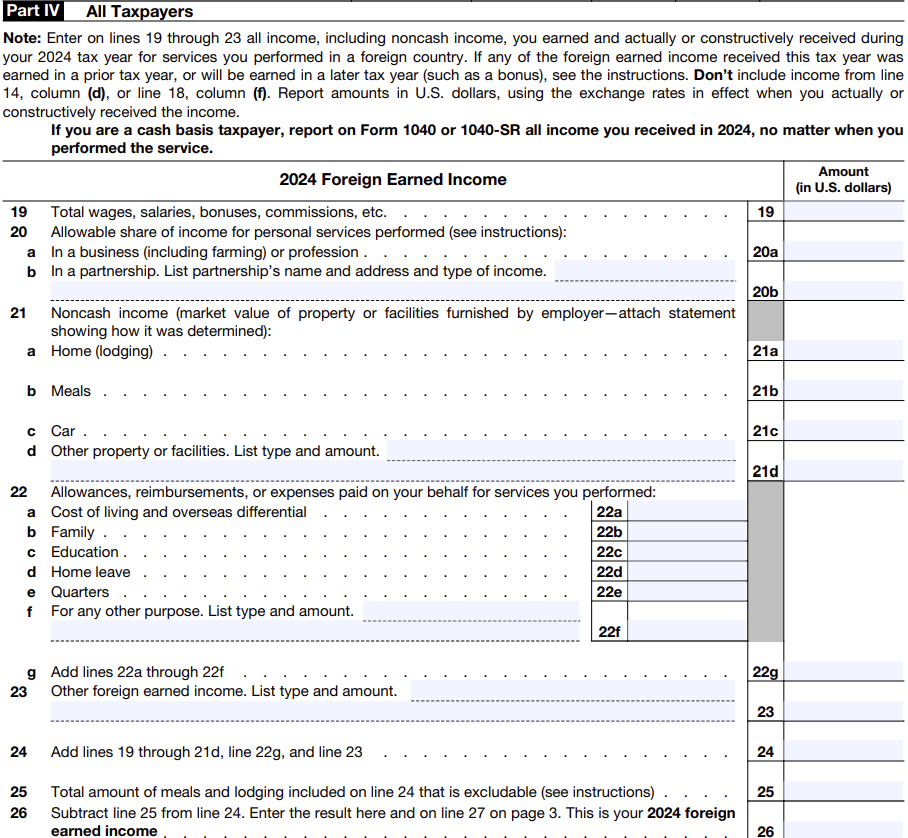

D. Part IV – Exclusion of Foreign Earned Income

This is where you calculate how much of the foreign earned income you’re allowed to exclude from U.S. tax. For tax year 2025, the maximum exclusion is $130,000. If you qualified for only part of the year, you’ll need to prorate the amount based on how many qualifying days you had.

You’ll enter your total qualifying income from Part III, then figure out how much of that falls within your qualifying period. If you earned less than the annual limit, you can usually exclude the full amount. If you earned more, the exclusion is capped at the annual maximum.

You’ll also be asked to list the total number of days you lived abroad during the year. Double-check that this number matches the days listed in Part II. If there’s a mismatch, your exclusion may be reduced or denied.

Pro Tip: If you’re married and your spouse also qualifies, each of you must file your own Form 2555. You can’t combine your exclusions.

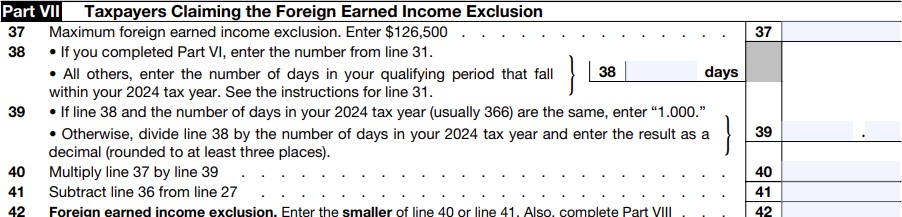

E. Part V – Housing Exclusion or Deduction

This section lets you exclude or deduct some of your housing costs if they exceed a base amount set by the IRS. This can help reduce your tax bill if you live in a country where housing is especially expensive.

F. Part VI – Factoring In The Housing Exclusion

Start by listing your qualified housing expenses. These may include:

- Rent

- Utilities (except phone)

- Property insurance

- Occupancy taxes

- Repairs and maintenance (if you’re a renter)

- Don’t include things like furniture, cable, or internet. Only basic housing costs qualify.

Next, calculate the total number of qualifying days during the year that you paid for housing while working abroad. Multiply this by the IRS base amount to determine how much of your housing cost is eligible. For most locations, the base is $17,710 per year ($48.52 per day), but it’s higher in some high-cost cities. The IRS publishes a list each year with adjusted caps based on location.

Pro Tip: If you’re an employee, your eligible housing costs may be excluded. If you’re self-employed, you may take them as a deduction instead. In either case, be ready to show receipts or lease agreements to back up your claim if asked.

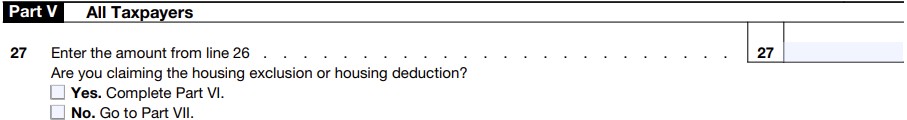

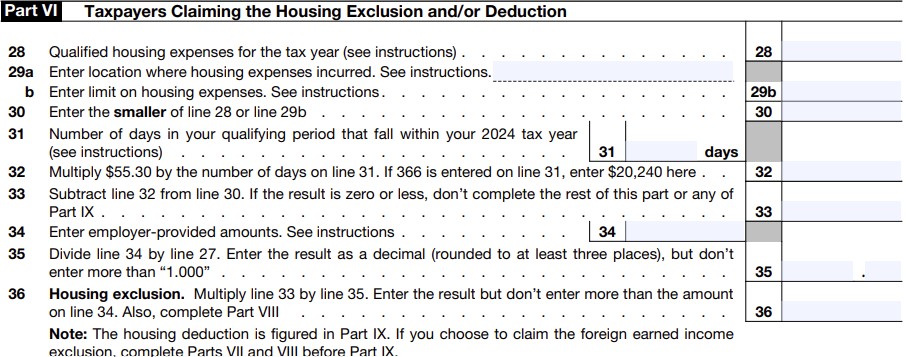

G. Part VII – Calculating Your Foreign Earned Income Exclusion

While Part IV focuses on calculating your maximum allowed exclusion amount, Part VII focuses on calculating the actual foreign earned income you can exclude. You’ll enter the maximum exclusion amount along with the number of qualifying days that you paid for housing, or the number of days in your qualifying period.

If the number of qualifying days is equal to the full year, then you enter 1 on line 39. Otherwise, you divide the number of qualifying days by the number of days in the year to get a decimal for line 39. You’ll then multiply your maximum exclusion by the number in line 39 to get your number in line 40.

Next, you’ll subtract your housing exclusion from your total foreign earned income for line 41. Your foreign earned income exclusion will then be the lesser of lines 40 and 41.

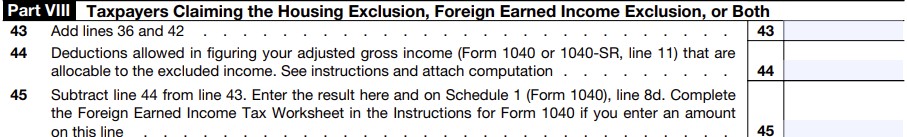

H. Part VIII – Housing Exclusion & FEIE (or Both)

This section combines your foreign earned income and housing exclusions and ensures that your deductions are properly allocated. You’ll start by writing in your housing exclusion and your foreign earned income exclusion.

You’ll then report any deductions allowed in calculating your AGI (e.g., self‑employment tax, Schedule C expenses) that are directly allocable to your excluded income. These go on Schedule 1, line 11 of Form 1040. Line 44 captures the portion that must be disallowed due to the exclusion.

Finally, you’ll subtract any deductions allocable to your excluded income from your FEIE and housing exclusions and add the amount from line 45 to your Schedule 1 on line 8d.

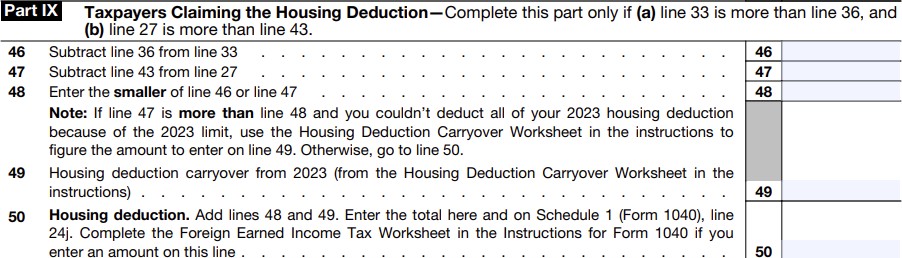

I. Part IX – Housing Deduction (If Eligible)

This section calculates your allowable housing deduction if any of your housing costs exceed what was excluded, or if you’re eligible for a deduction due to self-employment. You only need to complete this section if Line 33 (total housing amount) exceeds line 36 (housing exclusion), and line 27 (total foreign earned income) exceeds line 43 (total exclusions). If you end up with an amount in line 50, you’ll then complete the Foreign Earned Income Tax Worksheet in the Form 1040 instructions.

Common Mistakes To Avoid

Filing Form 2555 can help lower your U.S. tax bill, but small mistakes can lead to delays, denied exclusions, or an IRS audit. Many of these errors can be attributed to either misunderstanding how the rules work or misreporting dates and income. Here are some of the most common issues to watch out for when completing the form.

1. Using the Wrong Residency Test

You need to meet either the bona fide residence test or the physical presence test, but not both. Some taxpayers try to claim both or choose the wrong one based on where they plan to live instead of where they actually live and work. The IRS checks travel and residency records, so your dates need to match the test you’re using.

2. Miscounting Days Abroad

For the physical presence test, the 330 full days must fall within a 12-month period. People often miscount travel days or include partial days. A full day means a 24-hour period spent outside the U.S. Leaving the country at night and arriving overseas in the morning doesn’t count as a full day abroad. Mistakes here can disqualify your exclusion entirely.

3. Reporting Ineligible Income

Form 2555 only applies to income earned from active work. It doesn’t apply to dividends, capital gains, rental income, or retirement benefits. Including those amounts can reduce the exclusion or cause the IRS to question your return.

4. Using the Wrong Currency Conversion Rate

All foreign income must be reported in U.S. dollars. The IRS allows you to use the average yearly exchange rate, but if your income changed throughout the year, a monthly or daily rate might be more accurate. Rounding off too much or applying the wrong exchange rate can make your income totals look incorrect.

5. Forgetting to Prorate the Exclusion

If you didn’t live abroad for the full year, you need to prorate the exclusion based on the number of qualifying days. The IRS provides a formula to calculate this amount. Claiming the full exclusion without adjusting it for partial years is a common red flag.

6. Leaving Out Required Attachments

Form 2555 must be attached to your Form 1040. If you mail a paper return and forget to include it, the IRS won’t apply the exclusion. If you’re e-filing, make sure your tax software includes the form and submits it correctly.

Should You Use Form 2555 or the Foreign Tax Credit?

Form 2555 isn’t the only way to reduce U.S. taxes on income earned abroad. Another option is Form 1116, which is used to claim the Foreign Tax Credit. While both forms are meant to prevent double taxation, they work in different ways: the exclusion on Form 2555 removes eligible income from your return, while the credit on Form 1116 reduces the amount of tax you owe based on taxes you already paid to a foreign government.

Which one you use depends on your income, where you live, and how much foreign tax you’ve paid. If you work in a country with high tax rates and you pay income tax to that government, the Foreign Tax Credit might give you a bigger benefit. If you’re in a country with low or no income tax, the Foreign Earned Income Exclusion usually offers more value.

You can’t apply both options to the same income. However, in some cases, you may be able to use Form 2555 for part of your income and Form 1116 for other sources. This is more common for people with mixed income types, like wages and passive income. If you’re unsure which option will lower your tax bill the most, it may help to calculate both or speak with a tax professional who handles international filings.

Comparison: Form 2555 vs. Form 1116

| Feature | Form 2555 (Foreign Earned Income Exclusion) | Form 1116 (Foreign Tax Credit) |

| What It Does | Excludes a portion of earned foreign income from U.S. taxation | Reduces your U.S. tax based on foreign income taxes you’ve already paid |

| Applies To | Wages, salaries, and self-employment income earned abroad | Foreign income taxes paid on foreign income (earned or passive) |

| Max Benefit (2024) | Up to $126,500 per qualifying taxpayer | No fixed limit—depends on the amount of foreign tax paid |

| Best For | U.S. workers in countries with low or no income tax | U.S. workers in countries with high income tax rates |

| Residency Requirement | Must meet either the bona fide residence test or the physical presence test | No residency test required |

| Can You Claim Housing Costs? | Yes, through the foreign housing exclusion or deduction | No |

| Reporting Requirement | File with Form 1040 and attach Form 2555 | File with Form 1040 and attach Form 1116 |

| Can Be Used Together? | Only if applied to different types of income | Must not overlap with income excluded using Form 2555 |

Example Case: Choosing Between Form 2555 and Form 1116

Emma, a U.S. citizen, worked in the United Arab Emirates for all of 2024 as a marketing consultant. She earned $110,000 in wages and paid no income tax to the UAE government because the country doesn’t tax personal income. Since she lived abroad the entire year and met the physical presence test, she qualified for the Foreign Earned Income Exclusion. In her case, Form 2555 allowed her to exclude the full $110,000 from her U.S. taxable income, leaving little to no federal tax due.

David, another U.S. citizen, worked in Germany and earned $130,000 in 2024. Germany withheld income tax on his wages, and he paid about $40,000 in foreign taxes. Because his income exceeded the Form 2555 exclusion limit and he paid high taxes overseas, Form 1116 gave him a better outcome by allowing him to apply those taxes as a credit directly against his U.S. tax liability.

Do You Need a Tax Professional to File Form 2555?

Form 2555 is short, but accuracy is key. The IRS expects you to report exact dates, income amounts, and housing costs without errors. If you’re earning income abroad, your return may involve different currencies, travel timelines, and foreign housing expenses. Small mistakes, like listing the wrong residency period or misapplying an exchange rate, can delay your refund or cause your exclusion to be denied.

Working with a licensed tax professional can help you avoid these issues. A CPA or Enrolled Agent familiar with expat returns can help you meet the IRS requirements and complete the form correctly. This includes choosing the right residency test, calculating income properly, and applying the foreign housing exclusion or deduction if it applies. If you worked in more than one country, had gaps in income, or switched employers mid-year, professional support can save time and reduce the risk of errors.

At USA Tax Gurus, we assist U.S. citizens and resident taxpayers with filing accurate returns that include Form 2555. Our team provides clear guidance, verifies eligibility based on your time abroad, and makes sure that all required information is reported correctly. If you’d like support with your expat tax filing, we’re here to help.

Let USA Tax Gurus Help You File Your Taxes & Claim Your Foreign Earned Income Exclusion

If you’ve been working overseas and want to reduce your U.S. tax bill, Form 2555 may help. But to claim the Foreign Earned Income Exclusion, your records must be accurate and your filing must clearly reflect your time abroad. Small errors, like incorrect travel dates or missing income, can lead to problems. At USA Tax Gurus, we help people meet IRS filing requirements and avoid mistakes. We’ve worked with U.S. citizens and residents based in dozens of countries, and we know how to prepare returns that include Form 2555. If you’re unsure how to proceed or want someone to handle the filing for you, we’re ready to assist. For more information, please fill out our contact form or call 213-204-8737 today.