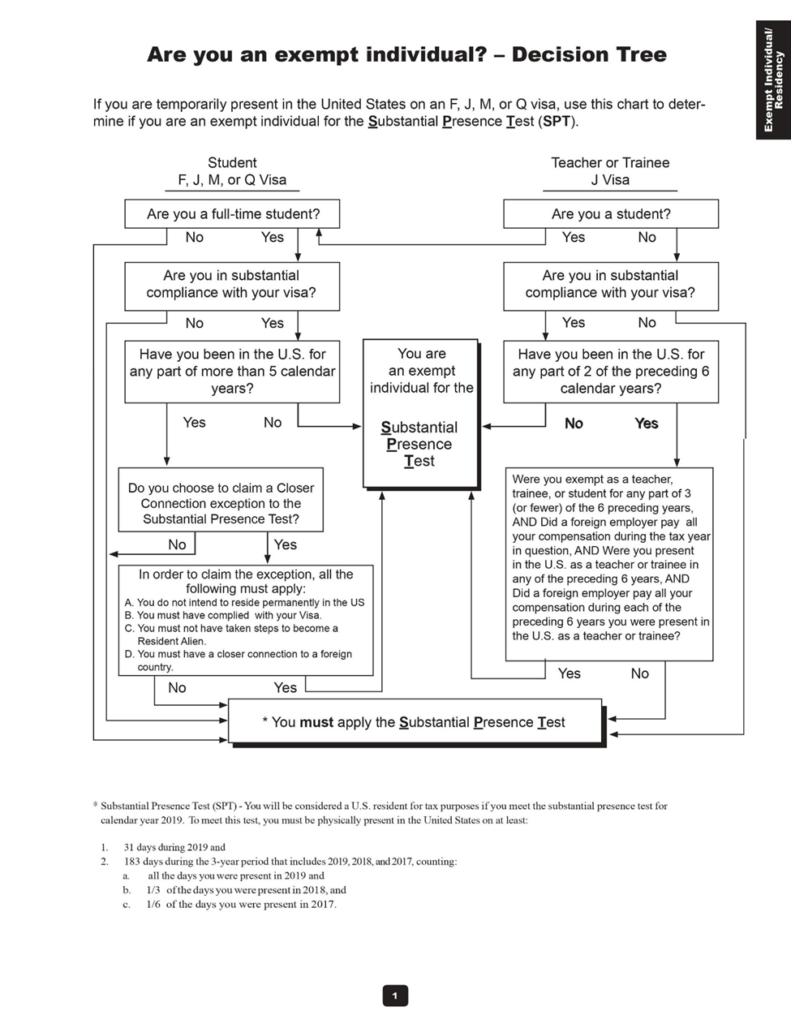

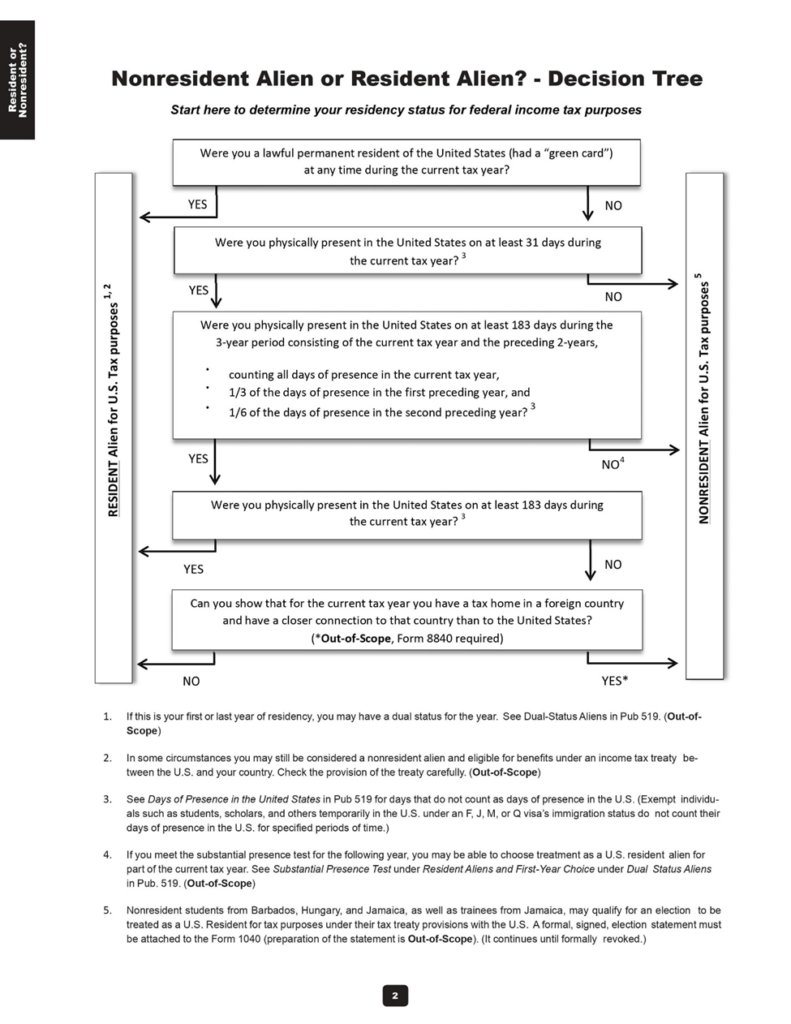

If you are not a U.S. citizen, you are considered a nonresident alien unless you meet one of two tests; i.e. green card test 1 or the substantial presence test 2 for the calendar year (Jan 1-Dec 31). However, international students on F and J visa are considered nonresident aliens for first 5 calendar years of their stay in the US even if they meet the 183 day rule of the substantial presence test.

What is a green card test and substantial presence test?

If you meet either of these two tests you will be considered a US resident for tax purposes.

Green Card Test: If you are a lawful permanent resident of US or USCIS has issued you an alien registration card, Form I-551, also known as a “green card”

Substantial Presence Test: If you are physically present in the US on at least 31 days during the current year, and 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

- All the days you were present in the current year, and

- 1/3 of the days you were present in the first year before the current year, and

- 1/6 of the days you were present in the second year before the current year

I am an international student on F visa and I meet the substantial presence test. Can I file a US resident (1040) return?

Yes and No. In short, if you have been in the US on F visa for more than 5 years and meet the substantial presence test in your 5th year, yes you will be considered a US resident and will need to file a form 1040. Students on F visa are considered exempt individuals for the purposes of substantial presence test for the first 5 years, hence the test doesn’t apply to them.

IRS Publication 4011 3 does a great job explaining the rules above. See below the extracts from the IRS publication:

Sources:

Source 1: Green Card Test

Source 2: Substantial Presence Test

Source 3: IRS Publication 4011 – Foreign Student and Scholar Resource Guide

Source 4: IRS Publication 519 – U.S. Tax Guide for Aliens