If you’ve paid income taxes to a foreign country, the IRS lets you reduce your U.S. tax bill through the Foreign Tax Credit. This credit, which is claimed using Form 1116, prevents you from paying tax twice on the same income. Many taxpayers qualify without realizing it, especially those earning foreign wages, dividends, interest, or business income.

Knowing how to complete Form 1116 correctly lets you take full advantage of the credit and stay compliant with U.S. tax reporting requirements. You’ll need to identify the type of foreign income you earned, report the taxes you paid or accrued, and calculate how much of that amount you can apply toward your U.S. tax liability. This guide outlines everything you need to know to complete Form 1116 and claim the Foreign Tax Credit during your next filing.

USA Tax Gurus is a team of enrolled agents and licensed CPAs who can help you take control of your business finances to maximize profits, reduce taxes, and provide increased financial clarity. We’re QuickBooks Pro Advisors, but our tech-savvy team can work in almost any accounting platform, including Wave, Zoho, and more. Schedule your free consultation today with a member of our team to learn more!

What Is the Foreign Tax Credit?

The Foreign Tax Credit (FTC) lets you offset U.S. income tax with income taxes you paid to a foreign country. You can claim the credit for taxes on wages, dividends, interest, royalties, or business profits earned abroad. The credit applies only to taxes on income, so you can’t include payments for property, sales, or value-added taxes.

You qualify for the Foreign Tax Credit if a foreign tax was imposed on you and you actually paid or accrued it. The country in question must also have the legal authority to tax that income. If you meet those requirements, you can use Form 1116 to reduce your U.S. tax owed by the same amount of eligible foreign tax. While the IRS limits the credit to the portion of your U.S. tax that applies to your foreign income, any unused amount can usually be carried to other years.

Some taxpayers choose the Foreign Earned Income Exclusion (Form 2555) instead, which excludes part of their foreign income from U.S. tax. You can’t claim both the exclusion and the credit on the same income, so you’ll need to decide which option provides the better result. For many people, the Foreign Tax Credit offers a larger benefit because it preserves other deductions and credits that might be reduced under the exclusion.

Who Needs to File Form 1116?

You need to file Form 1116 if you paid or accrued income taxes to a foreign country and want to claim the Foreign Tax Credit on your U.S. return. This includes U.S. citizens, resident aliens, and certain nonresident aliens who report worldwide income on Form 1040. If you earned money from a job overseas, received dividends or interest from a foreign company, or had capital gains from foreign investments, you’ll likely need to complete the form.

The IRS requires you to use Form 1116 if your total foreign taxes are more than $300 ($600 if married filing jointly). If your foreign taxes are below those amounts and meet other basic criteria, you can usually claim the credit directly on your Form 1040 without attaching Form 1116. However, filing the form can still be worthwhile if you expect to carry unused credits to future years or if your income includes several types of foreign sources.

Freelancers, contractors, and investors with international income should pay close attention to this requirement. Even small amounts of foreign tax can affect your U.S. tax liability. Filing Form 1116 ensures you get credit for taxes already paid abroad and helps you avoid overpaying the IRS.

Overview of IRS Form 1116

Form 1116 has three main parts, each capturing different information about your foreign income and the taxes you paid.

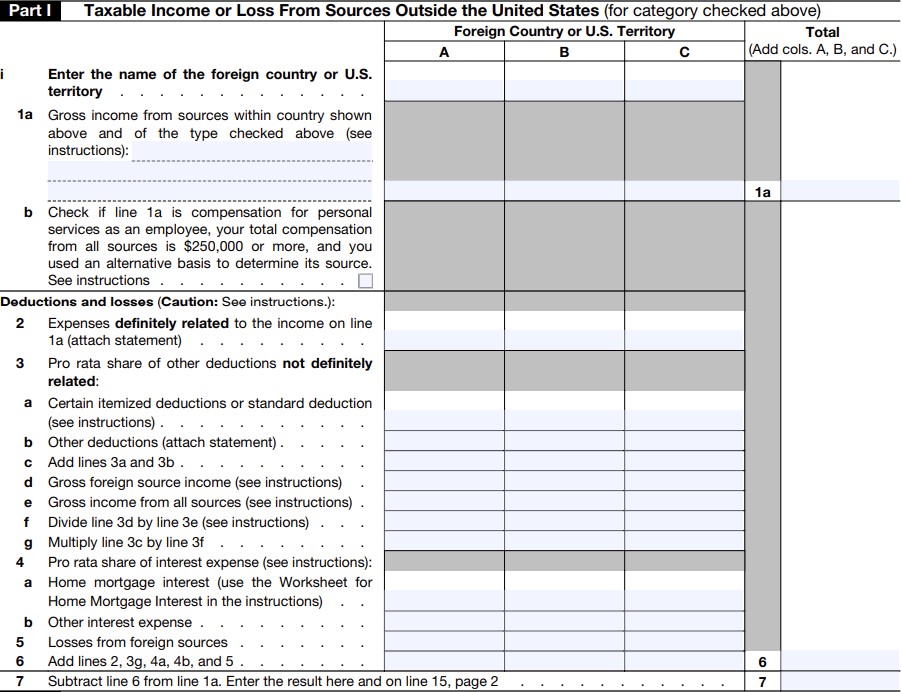

- In Part I, you report your foreign income and identify the category it falls under, such as passive income (dividends, interest), general income (wages, business income), or other specific categories. You must complete a separate Form 1116 for each category of income.

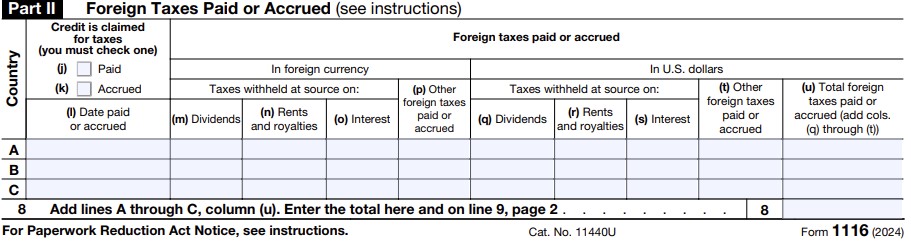

- Part II records the foreign taxes you paid or accrued during the tax year. You’ll list the country where the taxes were paid and whether they were withheld, billed, or accrued.

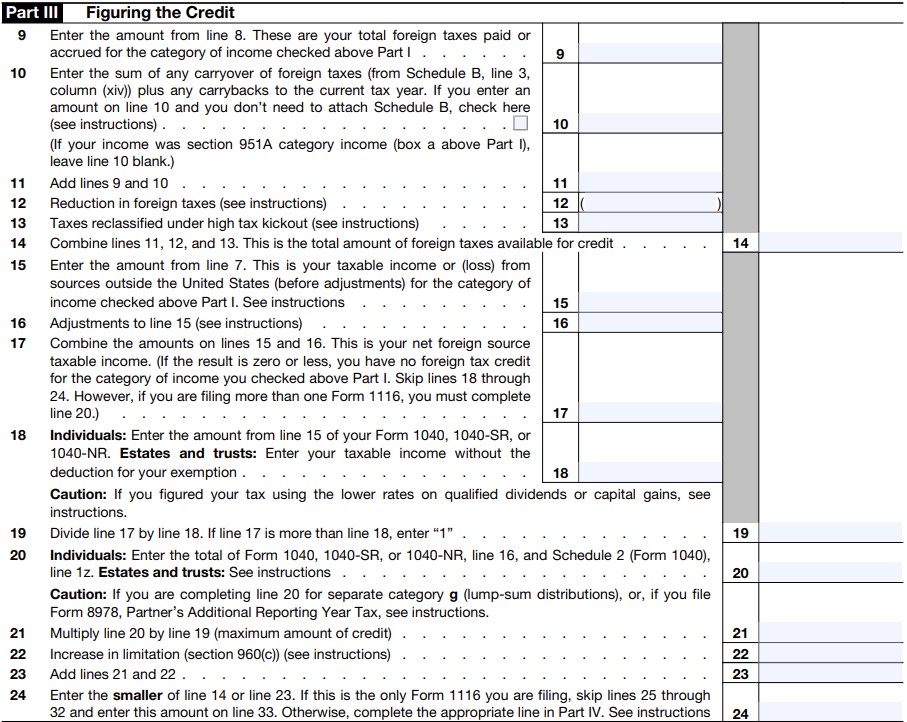

- Part III determines the actual credit you can claim by applying the IRS limitation formula, which verifies that the credit doesn’t exceed your U.S. tax on that same income.

You’ll attach Form 1116 to your Form 1040 when you file your return. Most tax software supports electronic filing for this form, but if you file by mail, make sure to include all supporting schedules and documentation. The IRS updates Form 1116 from time to time, so always use the most recent version available on the government website.

Step-by-Step Guide to Completing Form 1116

Filling out Form 1116 is easier when you take it section by section. Collect your income statements, foreign tax documents, and exchange rate information before you start.

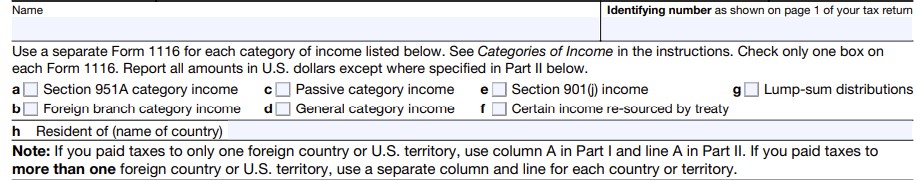

Step 1: Identify the Income Category

The IRS separates foreign income into categories because each one has different rules. Common categories include passive income (interest, dividends, and royalties) and general income (wages, salaries, and business earnings).

If you earned both types, you must complete a separate Form 1116 for each. Start by checking the instructions on page one of the form to mark the correct category box. Using the right category makes it easier to calculate your credit correctly and avoid a mismatch with your income on Form 1040.

Step 2: Report Foreign Source Income (Part I)

Next, report the total foreign income you earned during the year. Enter it in U.S. dollars using the exchange rate that applied when you received or accrued the income. The IRS allows you to use an average annual rate if the income was earned evenly throughout the year.

For each country, list the type of income and its amount. If your foreign bank or employer issued a statement showing taxes withheld, use that as your source. Keep copies for your records in case the IRS requests verification later.

Step 3: Report Foreign Taxes Paid or Accrued (Part II)

In this section, you’ll record the taxes you paid to a foreign government. Choose either the paid method (when you actually paid the tax) or the accrued method (when the tax became owed, even if unpaid). You must stay consistent with the method you use each year unless you get IRS approval to change it.

For each entry, include the name of the country, the amount of tax in foreign currency, and its U.S. dollar equivalent. If the tax was withheld at the source, use the official statement or withholding form to confirm the amount.

Pro Tip: The United States has income tax treaties with many countries that can reduce or eliminate double taxation. Before claiming a credit, review whether a treaty benefit applies to your income and how it affects the tax rate.

Step 4: Calculate the Credit (Part III)

Here you’ll determine the maximum credit you can claim. The IRS limits the Foreign Tax Credit to the portion of your U.S. tax that applies to your foreign income. Use the formula shown on the form:

(Foreign income ÷ Total taxable income) × U.S. tax liability = Maximum credit allowed.

If your foreign taxes exceed this limit, the extra amount can be carried back one year or carried forward up to ten years. Record the final allowable credit on your Form 1116 and then transfer it to the relevant line on your Form 1040.

Step 5: Attach and File

When you finish the calculations, attach Form 1116 to your Form 1040 or Form 1040-SR. Double-check that you’ve signed your return and included all required attachments, such as statements of foreign income, tax receipts, or translations. If you file electronically, the software will prompt you to upload or reference your documentation. Once submitted, keep a digital and printed copy for your records, along with your supporting documents, for at least three years.

What Happens If a Foreign Country Refunds the Taxes You Paid?

If a foreign government refunds, reduces, or reclassifies the income taxes you originally paid and claimed on Form 1116, you must report this change to the IRS. The IRS calls this adjustment a foreign tax redetermination. It applies when you receive a refund, credit, or any other benefit that lowers your original foreign tax amount.

When that happens, you’ll need to recalculate your Foreign Tax Credit for the year in which the original taxes were claimed. This recalculation may change the amount of credit you were entitled to, which can increase your U.S. tax for that prior year. In most cases, you’ll have to file an amended return (Form 1040-X) with a revised Form 1116 to reflect the correct amount.

If the adjustment affects multiple years (for example, if you carried forward unused credits), you must update each affected year. The IRS expects taxpayers to report these changes within one year of the foreign government’s final determination. Keeping detailed records of your foreign tax payments and any correspondence with foreign tax authorities makes it easier to comply and avoid penalties for underreporting.

Can You Claim the Credit Without Form 1116?

Yes, in some situations, you can claim the Foreign Tax Credit directly on your Form 1040 without completing Form 1116. The IRS allows this simplified method when your total foreign taxes are $300 or less ($600 if married filing jointly). These taxes must be on passive income, such as dividends, interest, or capital gains, and they must have been paid to a country that has a recognized tax relationship with the United States.

To qualify for this simplified credit, the foreign taxes must meet a few additional conditions. They must be legally owed, actually paid during the tax year, and based on income – not on property, sales, or value-added taxes. The foreign income must also be reported on a Form 1099 or Schedule K-1 issued by a U.S. financial institution or partnership. If the income came directly from a foreign account or an employer that didn’t issue a U.S. form, you usually must file Form 1116 instead.

Using the simplified method can save time, but it’s not always the best choice. If you have income from several countries, foreign business income, or any unused credits to carry forward, filing Form 1116 ensures that your credit is calculated correctly. The form also lets you track carrybacks and carryforwards, which can reduce your taxes in future years.

What If You File Late?

You can still claim the Foreign Tax Credit on a late or amended tax return, but there’s a strict deadline. The IRS allows you to claim the credit up to ten years from the original due date of the return for the year in which the foreign taxes were paid or accrued. This rule gives you time to correct prior returns if you later receive foreign tax documentation, discover additional income, or realize you were eligible for the credit but didn’t claim it.

If you file late, include all supporting records showing the foreign taxes you paid. These documents may include wage statements, bank dividend reports, or official foreign tax receipts. When you file an amended return (Form 1040-X), attach a new or corrected Form 1116 to recalculate the credit accurately. The IRS will adjust your prior-year U.S. tax liability based on the revised credit amount.

Keep your foreign tax records, translations, and correspondence for at least ten years after the original due date of the return. The IRS may request documentation to verify the credit, especially if the claim is made several years later. Filing on time when possible is always best, but knowing you have a ten-year window provides flexibility if you need to fix earlier filings or claim credits you initially missed.

Common Mistakes and How to Avoid Them

When you complete Form 1116, it’s important to review each section closely, as small errors can delay your return or reduce the credit you can claim. Here are common mistakes to watch for and how to prevent them:

- Mixing Up the Foreign Tax Credit and Foreign Earned Income Exclusion: You can’t claim both the foreign tax credit (FTC) and the foreign earned income exclusion (FEIE) for the same income. The foreign earned income exclusion allows you to exclude foreign earned income from US taxation, while the foreign tax credit helps you avoid double taxation by crediting income taxes paid to a foreign government. Decide which option benefits you more, and apply it consistently throughout your return. Many higher-income earners will exclude part of their income under FEIE and apply FTC to the rest.

- Using Incorrect Exchange Rates: Convert all amounts to U.S. dollars using either the rate on the payment date or an annual average rate. Apply the same method across your entire return.

- Selecting the Wrong Income Category: Make sure you separate passive income (dividends, interest, royalties) from general income (wages, self-employment earnings). Using the wrong category changes how the credit is calculated.

- Omitting Small Amounts of Foreign Income: Even minimal interest or dividend payments affect your credit calculation. Include every source of foreign income.

- Ignoring Carryback and Carryforward Rules: If your foreign taxes exceed the annual limit, record them for use in other years. You can carry them back one year or forward up to ten years.

- Failing to Keep Documentation: Save foreign tax receipts, withholding statements, and translations for at least three years. These records protect you if the IRS asks for verification.

By double-checking these areas before you file, you’ll reduce the chance of an IRS adjustment or credit disallowance. A few extra minutes of review can help you claim your full credit without future corrections.

When to Seek Professional Help

Form 1116 can become more challenging when your income comes from several sources or countries. If you own foreign investments, run a business abroad, or claim credits across multiple years, you might save time and prevent errors by getting help from a qualified tax professional. A CPA or enrolled agent experienced in international taxation can review your documentation, calculate your credit correctly, and make sure you meet all reporting rules.

Professional help is especially useful if you have carry-forward or carry-back amounts, mixed foreign income types, or tax treaty benefits that change how the credit applies. Working with someone familiar with both U.S. and foreign tax systems can also help you identify deductions or elections you may have missed.

At USA Tax Gurus, you can get help from accountants and advisors who work daily with foreign tax credit filings and cross-border reporting. You’ll receive clear guidance on which forms you need, how to prepare them, and how to make the most of available credits. If you’d like assistance with your next return, reach out for a consultation before filing season begins.

Do You Have Questions About IRS Tax Form 1116?

Claiming the Foreign Tax Credit through Form 1116 helps you reduce double taxation and keep more of your income. If your situation includes multiple foreign countries, carry-forward amounts, or business income abroad, USA Tax Gurus can help you review your return and confirm your calculations before submission. Preparing your return carefully helps you stay compliant and make the most of tax rules that work in your favor. By following the right steps now, you can keep your international income reporting accurate. For more information or to schedule a consultation with a CPA at USA Tax Gurus, please fill out our contact form or call 213-204-8737 today.